Our comprehensive online guide, compiled and coordinated by Olivier Teixeira, provides detailed insights into how these changes are being implemented under Pillar Two across various jurisdictions, offering valuable information for companies navigating these new tax landscapes.

Brief overview of the OECD’s two-pillar solution

In July 2021, no fewer than 138 countries agreed on the “two-pillar solution”, an approach initiated by the G20 and the OECD covering wide-ranging reform of international corporate taxation for large multinational enterprises. The aim is to give market jurisdictions a greater share in the profits of the world’s 100 largest corporations by partially reallocating taxing rights. In addition, a global effective minimum tax rate of 15% is to be introduced:

Pillar One

The OECD’s Pillar One focuses on the allocation of international taxing rights for multinational enterprises. New nexus rules aim to reallocate taxing rights from the domicile for tax purposes to the market jurisdiction in which a corporation generates its profits, regardless of whether firms have a physical presence there. The reallocation of taxing rights affects global companies in all sectors, but in particular large digital corporations with annual turnover of ≥ EUR 20 billion and profitability of > 10%. Pillar One is to be implemented through a Multilateral Convention, which is currently still being negotiated and is expected to enter into force in 2024.

Pillar Two

The OECD’s Pillar Two provides for the introduction of a global effective minimum tax rate of 15%. The international community’s aim here is to reduce international tax competition between countries and to counteract the shifting of corporate profits to low-tax countries, which results in erosion of the revenue base in the affected countries. It covers all international corporations with minimum consolidated turnover of EUR 750 million.

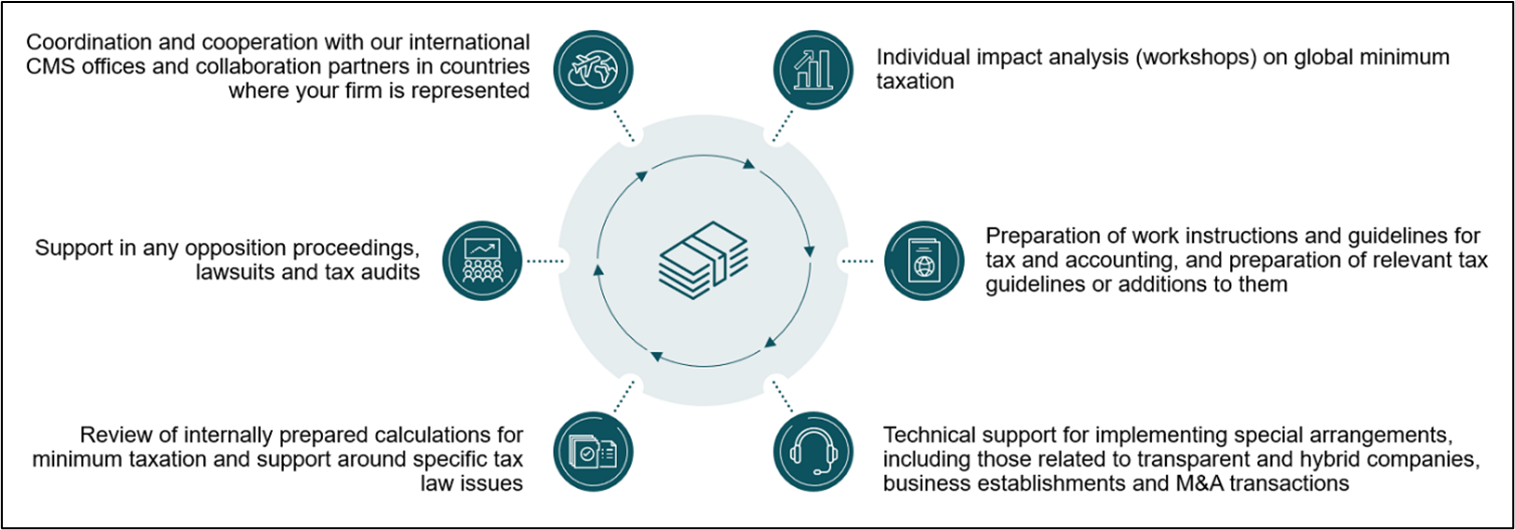

The regulations are accompanied by extensive reporting and information requirements. To comply with these obligations, the companies concerned must above all introduce new processes for tax compliance and accounting, so that they can obtain the necessary data promptly and analyse it.

Focus topic: Global minimum taxation under Pillar Two

| Stages in the introduction and implementation of global minimum taxation |

|---|

| 2021 | 2022 | 2023 |

July The Inclusive Framework (IF) on Base Erosion and Profit Shifting (BEPS), set up by the OECD and G20, reaches an international agreement in principle on the “two-pillar solution”, which 138 states and jurisdictions have now joined; G20 finance ministers approve the basic proposal at their meeting in Venice; October The Inclusive Framework on BEPS clarifies technical details and agrees on a schedule for implementing the measures; G20 finance ministers approve the technical details and the schedule for implementation during a meeting in Washington, D.C; December The OECD publishes internationally agreed model regulations as a blueprint for transposing the global effective minimum taxation into national law. | March Publication of an OECD Model Commentary to supplement the Model Rules. The Model Commentary is intended as an aid to interpretation (“Tax Challenges Arising from the Digitalisation of the Economy – Commentary to the Global Anti-Base Erosion Model Rules (Pillar Two), First Edition”); December The EU member states agree on a common directive for uniform implementation within the European Union (EU), which must be transposed into national law by the end of 2023 (“Council Directive (EU) 2022/2523 of 14 December 2022 on ensuring a global minimum level of taxation for multinational enterprise groups and large-scale domestic groups in the Union”). | February The OECD develops an Implementation Framework, aimed at facilitating coordinated implementation of Pillar Two (“Agreed Administrative Guidance for the Pillar Two GloBE Rules”); July On 17 July, the OECD (i.e. the IF) publishes extensive new documents relating to the introduction of Pillar Two, including further “Agreed Administrative Guidance” (AAG). The IF has announced that more AAGs will be published in the future as well as a consolidated version; |

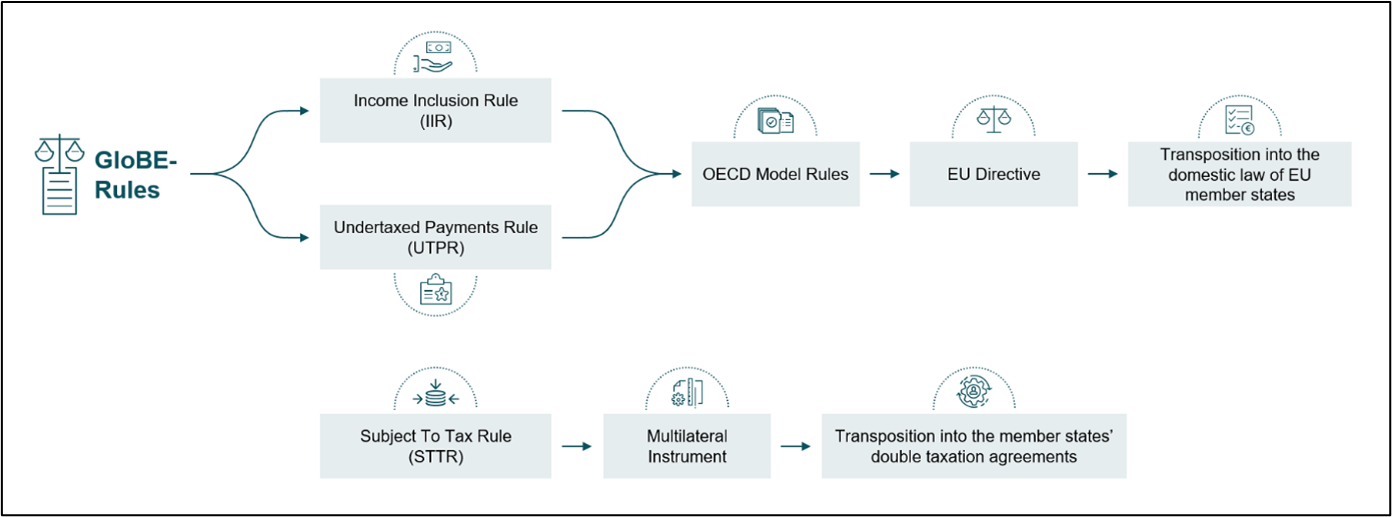

Rules and tools in the context of Pillar Two

Pillar Two consists of the Global Anti-Base Erosion Rules (GloBE Rules), which are sub-divided into an Income Inclusion Rule (IIR) and an Undertaxed Payments Rule (UTPR). The IIR is intended as a primary tool to achieve minimum taxation by imposing top-up tax on a parent entity. In contrast, the UTPR is only applied as a supplementary measure, by compensating for minimum taxation through denying deductions for payments within the group or comparable mechanisms. It is also possible to levy a Qualifying Domestic Minimum Top-Up Tax (QDMTT). This is a national supplementary tax levied on companies domiciled in a particular tax jurisdiction, enabling the minimum level of taxation to be achieved for that jurisdiction. There is also a Subject To Tax Rule (STTR) for certain related party payments subject to tax below a minimum rate.

While the GloBE Rules will be transposed into the law of the participating states by the respective national lawmaker, the STTR, which is based on double taxation law, will be implemented by means of a Multilateral Instrument (MLI), to be ratified accordingly by the member states.

Uniform transposition of GloBE Rules in the single market by way of a EU directive

When the OECD initially published the Model Rules for uniform transposition of GloBE Rules in the participating states on 20 December 2021, the European Commission presented a draft directive on 22 December 2021 aimed at ensuring harmonised transposition of the GloBE Rules within the EU. The directive was adopted by the EU in December 2022 (Council Directive [EU] 2022/2523 of 14.12.2022, “Minimum Taxation Directive”). The directive requires all member states to transpose the rules into domestic law by 31 December 2023. The content largely follows the OECD’s Model Rules, but also includes some adjustments to ensure compliance with European law.

The Model Rules have been given the status of a common approach by the OECD, i.e. participating states are not required to adopt the rules. If they choose to do so, however, they must adhere to the stipulations of the IF. At all events, states are required to accept application of the rules by other member states. Unlike the OECD Model Rules, the GloBE Rules in the EU directive are not designed as a common approach. Instead, the directive stipulates mandatory transposition of the GloBE Rules within the single market by EU member states. The directive also goes beyond the Model Rules in that purely national corporations will fall within its scope.

The directive stipulates that member states must transpose it by 31 December 2023, with most of the provisions applicable from 1 January 2024.

Social Media cookies collect information about you sharing information from our website via social media tools, or analytics to understand your browsing between social media tools or our Social Media campaigns and our own websites. We do this to optimise the mix of channels to provide you with our content. Details concerning the tools in use are in our privacy policy.